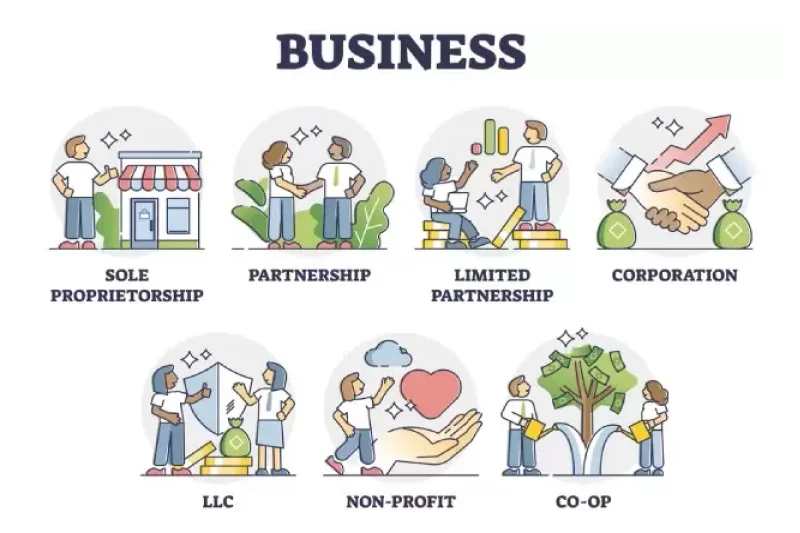

Types of businesses:

- Sole Proprietorship

- General Partnership

- Limited Liability Company (LLC)

- Corporation

- Nonprofit Organization

- Cooperative

- Limited partnership

- Close corporation (CC)

- Public benefit corporation (PBC)

- Joint ventures

Understanding the different types of businesses is essential for anyone starting a company or exploring entrepreneurial ventures. The business structure you choose will influence how your business operates, how you’re taxed, and what kind of liability protection you have. It also affects things like how you raise money, how decisions are made, and how much paperwork is involved in business compliance.

Choosing the right business entity isn’t just a legal formality—it’s a foundational step in business formation that can have long-term implications. Whether you’re a solo entrepreneur or planning to launch a company with partners or investors, having a solid understanding of the types of business entities will help you make smarter decisions.

1. Types of Businesses

1.1. Sole proprietorship

A sole proprietorship is the most basic type of business. It’s owned and operated by one person, and it doesn’t require a separate legal entity. This means the owner and the business are legally the same.

This structure is known for its simplicity. You have full control, and the income is taxed once through your personal tax return. These are some key advantages of a sole proprietorship—tax benefits, easy setup, and complete decision-making power.

However, there are disadvantages too. The biggest one is unlimited personal liability. If your business runs into debt or legal trouble, your personal assets could be at risk. It can also be harder to raise funds since you can’t sell shares and banks may view sole proprietorships as riskier.

Example: A freelance graphic designer working independently from home is a common example of a sole proprietor.

1.2. General partnership

A general partnership is a business owned by two or more people who share profits, losses, and management duties. It’s a step up from a sole proprietorship and still relatively easy to form.

There are different kinds of partnerships in the business types list, including limited partnerships and general partnerships. In a general partnership, all partners are equally responsible for debts and obligations.

Advantages include shared resources, combined skills, and a straightforward setup. Partners can bring in capital, divide responsibilities, and support one another in running the business.

But there are also disadvantages. All partners share liability, which means one partner’s mistake can affect everyone. Disagreements and power struggles can also occur, especially if there’s no clear operating agreement.

Example: A law firm started by two attorneys who co-manage the office and clients is a typical general partnership.

1.3. Limited liability company (LLC)

A limited liability company (LLC) is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. It’s a separate legal entity, meaning the business exists apart from its owners.

An LLC offers several key benefits. One of the biggest advantages is that it shields the owners (called members) from personal liability. That means their personal assets are generally protected if the business faces debts or lawsuits. Another plus is flexible management—owners can choose how the business is run. LLCs also have tax options, such as being taxed as a sole proprietorship, partnership, or corporation.

But there are disadvantages too. Rules for LLCs vary from state to state, which can make things confusing. Plus, owners might face self-employment taxes, depending on how the LLC is taxed.

Example: A small manufacturing company that wants legal protection and tax flexibility may choose to register as an LLC.

1.4. Corporation

A corporation is a more complex business entity. It’s a fully separate legal structure from its owners (called shareholders), offering strong liability protection. Corporations are part of the broader business types list and are ideal for companies that want to raise funds or expand widely.

There are two main types of corporations: C Corporation and S Corporation.

- C corporation:

A C Corporation is the standard form. It allows unlimited shareholders and is ideal for businesses looking to raise capital from investors. One of the key advantages is that it can attract venture capital. It also has corporate governance rules, like having a board of directors and issuing articles of incorporation.

However, C Corporations face tax implications. They’re taxed at the corporate level, and shareholders are taxed again on dividends—this is called double taxation. There’s also more paperwork and strict business compliance rules.

- S corporation:

An S Corporation is designed to avoid double taxation. Instead of taxing the business, profits and losses pass through to shareholders’ personal tax returns. This can be a big advantage for small businesses.

Still, there are limits. To qualify, an S Corp must meet strict eligibility criteria—like having no more than 100 shareholders and only one class of stock. This makes it less flexible than a C Corporation in some ways.

Example: A fast-growing tech startup might become a C Corporation to access funding from institutional investors and issue shares.

1.5. Nonprofit organization

A nonprofit organization is a type of business created to serve a public or social cause rather than to make a profit. Any money earned is used to support its mission rather than being distributed to owners or shareholders.

The main purpose of a nonprofit is to help others—whether that’s through education, health, the environment, or other community-focused goals. One of the biggest advantages is its tax-exempt status, meaning it doesn’t pay federal income taxes on money related to its mission. Nonprofits can also apply for grants, which are often not available to for-profit entities.

However, there are disadvantages too. Running a nonprofit requires following strict regulatory requirements, including detailed reporting and public transparency. There are also profit limitations, meaning the organization can’t distribute profits to founders or board members.

Example: A community health charity that provides free medical checkups and wellness programs would be considered a nonprofit organization.

1.6. Cooperative

A cooperative is a type of business entity that is owned and operated by its members. These members could be customers, employees, or suppliers. Each member has a say in how the cooperative is run, making it a democratic business structure.

The advantages of a cooperative include shared benefits—profits are distributed among members—and democratic control, where every member typically has one vote, regardless of investment size. It’s a model that promotes fairness and shared responsibility.

Still, there are disadvantages. Cooperatives may face slower decision-making due to the need for consensus. There can also be profit distribution complexities, especially as membership grows and financial goals differ.

Example: A neighborhood food co-op where members both shop and help manage the store is a classic cooperative model.

1.7. Limited partnership

A limited partnership is another form of business entity that includes both general and limited partners. General partners manage the business and carry liability, while limited partners invest money but have limited control and liability protection. This structure is useful for raising capital without giving up full control.

1.8. Close corporation (CC)

A close corporation (CC) is a type of business entity designed for a small number of shareholders. It offers the liability protection of a corporation but with fewer formal requirements. Shareholders often manage the business directly, making it ideal for family-owned or closely held companies.

1.9. Public benefit corporation (PBC)

A public benefit corporation (PBC) is a business structure that balances profit and purpose. It’s a for-profit company that also focuses on creating a positive impact on society or the environment. While it operates like a traditional corporation, it’s legally committed to both shareholders and the public good.

1.10. Joint ventures

Joint ventures are temporary partnerships between two or more businesses working together on a specific project or goal. Each party contributes resources and shares profits or losses. It’s one of the different types of businesses often used for expansion, entering new markets, or large-scale collaborations.

2. Choosing the right business structure

When starting a business, one of the most important steps is choosing the right business structure. The structure you select affects your daily operations, taxes, and personal liability protection. It also impacts your ability to raise money and the amount of paperwork involved in business compliance.

To choose the best fit, consider several key factors:

- Liability: Do you want to protect your personal assets in case your business faces legal issues or debt?

- Taxation: Are you comfortable with pass-through taxation, or would corporate taxation suit you better?

- Funding needs: Do you plan to attract investors or keep the business privately funded?

- Operational complexity: Are you looking for something simple like a sole proprietorship, or are you prepared to handle the detailed requirements of a corporation?

Each of the types of business entities—from LLCs and corporations to partnerships and nonprofit organizations—offers different pros and cons. That’s why it’s important to consult with legal and financial advisors. These professionals can help you understand your options based on your goals, resources, and long-term vision for the business.

For more support, you can also explore resources like the U.S. Small Business Administration. They offer useful guides and tools to walk you through the business formation process.

3. Conclusion

Choosing the right business entity is more than a paperwork decision—it’s a strategic move that shapes your company’s future. Whether you’re starting a solo project, launching a corporation, or building a cooperative, understanding your options helps avoid costly mistakes.

Think carefully about your needs and goals. Evaluate the legal, financial, and operational sides of your idea. Then, seek professional advice to make the best choice for your entrepreneurial venture. The right business structure sets a strong foundation for growth, success, and sustainability.

4. FAQs

4.1. What are the different types of business entities?

There are several types of business entities, including sole proprietorship, partnership, limited liability company (LLC), corporation (S Corporation and C Corporation), nonprofit organization, and cooperative. Other forms include limited partnership, close corporation, public benefit corporation, and joint ventures.

4.2. What are the characteristics of sole proprietorships and partnerships?

A sole proprietorship is owned by one person, offers full control, and is easy to start. But it also comes with unlimited personal liability. A partnership is owned by two or more people who share profits and responsibilities. It offers shared resources and diverse skills, but also shared liability and potential conflicts.

4.3. What are the advantages of forming a limited liability company?

A limited liability company (LLC) provides liability protection for its owners, flexible management, and various tax options. It’s one of the most popular business structures because it combines features of both partnerships and corporations.

4.4. What are the differences between S corporations and C corporations?

A C Corporation is taxed at the corporate level and can have unlimited shareholders. It’s ideal for large or growing businesses. An S Corporation avoids double taxation by passing income to shareholders’ personal returns, but it has stricter ownership rules. Both offer liability protection and require formal corporate governance like a board of directors and articles of incorporation.

4.5. How to choose the right business structure for your startup?

Think about your goals, how much liability protection you need, your tax implications, and how you plan to raise money. Each business entity has its strengths and weaknesses. It’s smart to talk with legal and financial advisors to find the best fit for your startup.

4.6. What are the main legal business structures available?

The most common legal business structures include sole proprietorship, partnership, LLC, corporation, nonprofit organization, and cooperative. Each structure impacts your business formation, compliance, taxes, and personal liability differently.